Contents:

Take-away accounting exercises will be provided to participants after each session. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Synder’s customer support team is ready to help you 24/7 to improve efficiency and productivity of your business!

- Accounting software will permit Joe to generate the financial statements and other reports that he will need for running his business.

- Auditors and forensic accountants are another important branch of the field.

- To obtain CPA licensure, a candidate must meet eligibility criteria and pass a demanding four-part standardized exam.

- Payroll also includes fringe benefits distributed to employees and income taxes withheld from their paychecks.

- At least one debit is made to one account, and at least one credit is made to another account.

The fact remains that if a business is lowly performing, no positive change can occur by the owner assuming that there is no problem. So there is need of keeping track on the performance of one’s business venture which is only possible with accounting knowledge. A business’s six basic accounts are Assets, Liabilities, Equity, Revenue, Expenses, and Costs. If you are going to offer your customers credit or if you are going to request credit from your suppliers, then you have to use an accrual accounting system. You can always track how much money you have on hand and how much you’ll need to spend in the future due to some circumstances.

Accounts Receivable & Accounts Payable

Diversification describes a risk-management strategy that avoids overexposure to a specific industry or asset class. To achieve diversification, people and organizations spread their capital out across multiple types of financial holdings and economic areas. Depreciation applies to a class of assets known as fixed assets.

A Beginner’s Guide to Management Accounting – The Motley Fool

A Beginner’s Guide to Management Accounting.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

The relationship between these components is illustrated in the accounting equation, which is used to verify the balance sheet is correct and balanced. Financial ReportingFinancial reporting is a systematic process of recording and representing a company’s financial data. The reports reflect a firm’s financial health and performance in a given period. Management, investors, shareholders, financiers, government, and regulatory agencies rely on financial reports for decision-making. Businesses and organizations use a system of accounts known as ledgers to record their transactions.

Accounting Basics Guide for Beginners

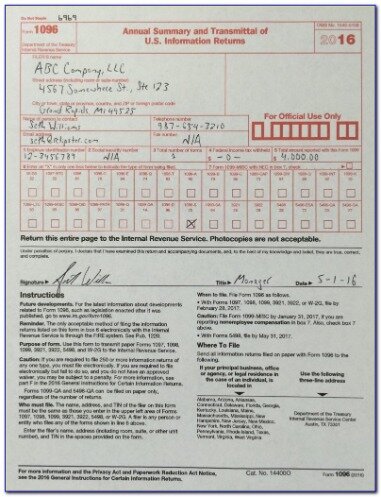

Financial Data about individuals like past Months Bank Statement, Tax return receipts helps banks to understand customer’s credit quality, repayment capacity etc. The general ledger is where the dual-entry transaction are recorded. Each individual record is made in the relevant account within the ledger. So, for a cash bill payment, an entry would be made in the cash account and another, separate entry made in the accrued expenses account.

QuickBooks For LLC: Pros, Cons And How To Set Up – Forbes

QuickBooks For LLC: Pros, Cons And How To Set Up.

Posted: Thu, 19 Jan 2023 08:00:00 GMT [source]

At the end of this lesson, you as an entrepreneur should be able to carry out all the processes that are in the accounting cycle as it will be revealed. Like many other jobs, accounting has both strategic and analytical tasks. It’s more than just keeping track of transactions or paying taxes. Accounting is thinking about how regulatory agencies, organizations, and tax collectors will use your financial records. Accounting ReportsAccounting reports are created using a company’s accounting data to check ledger-by-ledger transactions over a given time period.

Closing the Books

Banks use the financial records one have as strength to finance one’s project. Ms. Dopjera, a Certified Public Accountant, has 38 years of experience focused on accounting and regulatory reporting for financial institutions. The impact of debits and credits posted to the major categories of assets, liabilities, equity, income, and expense. Revenue is all the income a business receives in selling its products or services.

Strong analytical and problem-solving skills are important so you can develop financial statements, understand numbers, and make predictions from those financial statements. However, good interpersonal skills are also essential for when you work on teams. Conservatism is a principle that advises that an accountant may report potential losses for a business , but he may not report potential gains as actual gains.

The Fantastic Four of accounting

Revenue – the reflection of the customers’ value for the product. That’s actually what you’re going to gain by selling services or something else. To put it simply, it’s the Price + Quality of the sold products. Keeping the business running will cost money, like paying Abdullah a salary, paying for the transport vehicle, running ad campaigns, etc. Losses are the removal or decrease in an asset or business resource.

An accounting cycle is an eight-step system accountants use to track transactions during a particular period. Accounting is the process of tracking and recording financial activity. People and businesses use the principles of accounting to assess their financial health and performance. Accounting also serves as a useful way for people and companies to honor their tax obligations.

In professional practice, trial balances function like test-runs for an official balance sheet. A certified public accountant is an accounting professional specially licensed to provide auditing, taxation, accounting, and consulting services. For example, a company that hired an external consultant would recognize the cost of that consultation in an accrual. That cost would be recognized regardless of whether or not the consultant had invoiced the company for their services. In this course, you will learn how to manage accounts and financial transactions to operate a successful business. This tutorial includes tons of interactive exercises to help you create financial accounts.

That equity may then be reinvested back into the business to fuel its future growth. Accountants sometimes make future projections with respect to revenues, expenses, and debts. The concept of “present value” describes calculated adjustments that express those future funds in present-day dollars. We also explain relevant etymologies or histories of some words and include resources further exploring accounting terminology. It was developed for students and entrepreneurs to build their familiarity with accounting vocabulary. Independent contractors include freelancers, consultants, and other outsourced experts that aren’t formally employed by your business.

How to Get Started with Financial Accounting

If the income and expenses don’t correlate, the costs must be charged to expenses. This concept highlights the necessity of recording the cause and effect of revenues and expenses. Financial StatementFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . Chart Of AccountsA chart of accounts lists all the general ledger accounts that an organization uses to organize its financial transactions systematically. Every account in the chart holds a number to facilitate its identification in the ledger while reading the financial statements.

She has worked in private industry as an accountant for law firms and for ITOCHU Corporation, an international conglomerate that manages over 20 subsidiaries and affiliates. Matos stays up to date on changes in the accounting industry through educational courses. In its most basic sense, accounting describes the process of tracking an individual or company’s monetary transactions. Accountants record and analyze these transactions to generate an overall picture of their employer’s financial health. A trial balance is a report of the balances of all general ledger accounts at a point in time. Accountants prepare or generate trial balances at the conclusion of a reporting period to ensure all accounts and balances add up properly.

Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. While most businesses run an income statement monthly, smaller businesses may run an income statement quarterly, or even yearly if desired. If you’re using the accrual method of accounting, you will use the accounting equation every day. The chart of accounts may change over time as the business grows and changes. When running a business, it’s important to understand the value that each customer brings to your company.

After submitting your application, you should receive an email confirmation from HBS Online. If you do not receive this email, please check your junk email folders and double-check your account to make sure the application was successfully submitted. No, all of our programs are 100 percent online, and available to participants regardless of their location.

Basic Accounting Terminology and Concepts

This calculation will also be reflected on your business’s Schedule C tax document. Like many careers, accounting is a mix of tactical and analytical tasks. Accounting is thinking about what your financial records will mean to regulators, agencies, and tax collectors. Take charge in choosing the accounting methods for your business and the design of your accounting reports. All too often, business managers adopt the policy that accounting is best left to the accountants. Unfortunately, this may result in your not fully understanding your own financial information.

Abdullah will almost certainly start his business with some of his own money. Abdullah has also talked to a lawyer about what kind of business he could start. They decided that a corporation was best for him because of his situation. Abdullah decides that Wasslak will be the name of his business.

Prof. Jyoti Peswani has been actively engaged in the educational field for the last 5 years and has worked hands-on as a tax consultant and financial analyst. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Accounting as a discipline has a long history that is not captured in this module. However, as an entrepreneur/learner, it is necessary to understand the meaning of this concept and what it entails.

A Beginner’s Guide to Bookkeeping Basics – The Motley Fool

A Beginner’s Guide to Bookkeeping Basics.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

She states that unearned revenue software will allow for the electronic recording, storing, and retrieval of those many transactions. Accounting software will permit Joe to generate the financial statements and other reports that he will need for running his business. Net profit describes the amount of money left over after subtracting the cost of taxes and goods sold from the total value of all products or services sold during a given accounting period. If the net profit is a negative number, it is called net loss.

Keine Kommentare vorhanden